How Publicis won the data war and what Omnicom-IPG needs to do to stand a chance

The Epsilon data unit has emerged as one of the biggest weapons of its recent Publicis Groupe success, helping its stock soar by nearly 70% since the beginning of 2023.

“The operations of Epsilon and Publicis Media are now fully intertwined and at the heart of our connected media ecosystem,” Arthur Sadoun, CEO said investors during its third-quarter earnings call this year.

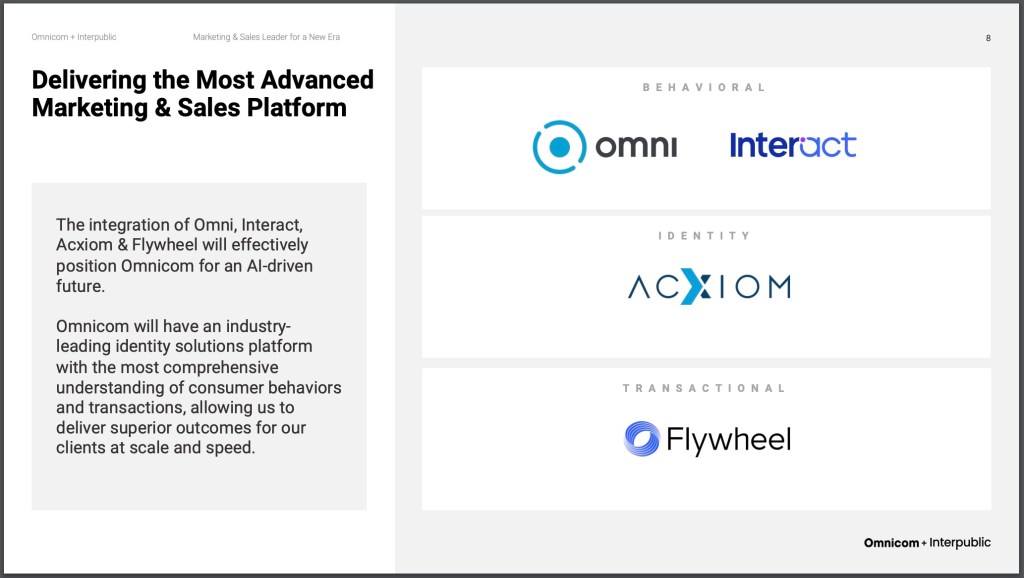

Competitors Omnicom and IPG, in the early stages of a $13 billion mega-merger, claim have the assets to rival Publicis’ data prowess. THE investor presentation of the acquisition touted the integration of Omnicom’s Omnicom (which provides insights from data), Omnicom’s Flywheel (a provider of business data), IPG’s Interact (a marketing platform) and the IPG Acxiom data unit.

Screenshot of Omnicom and IPG investor presentationOmnicom, IPG

Screenshot of Omnicom and IPG investor presentationOmnicom, IPG

Yet neither Omnicom nor IPG have been able, individually, to match Publicis’ data capabilities, according to multiple sources familiar with their data strategies. The stakes were particularly high for IPG, which spent billions to acquire a data unit.

Many doubt whether a newly merged company can benefit from combining its capabilities.

“It’s four years too late,” said a source close to the matter, speaking on condition of anonymity. “All this should have been done before AI appeared. Publicis is probably in a much better position because it did the heavy lifting first. »

An Omnicom spokesperson said the company believes that with IPG, “we will have the most advanced marketing and sales platform in the industry.”

ADWEEK spoke to seven sources who have worked at Omnicom, IPG or Publicis. Some have worked on several of these holdco data units. They explained what Publicis did right, how IPG fell behind, and revealed what the merged holding company would need to do to catch up.

“I thought the agencies would welcome us warmly… But they closed the door. »

While Epsilon and Acxiom were both in the world of data marketing, they offered different solutions. IPG bought Acxiom in 2018 for $2.3 billion and Publicis bought Epsilon in 2019 for almost $4 billion.

A second source directly familiar with the two data units noted a marked difference in how each portfolio company integrated them.

Sadoun demanded that all of Publicis work with Epsilon.

“It was top to bottom,” the source said. “Leadership and tone from the top made all the difference. It was really, ‘This is how it’s going to be, and if you don’t like it, you can leave.’ But we are going to market a joint solution here, between the agencies and Epsilon.

IPG didn’t go to market with the same degree of urgency, this person said, and CEO Philippe Krakowsky was more “lighthearted,” letting each store decide whether or not it wanted to work with Acxiom .

Certainly, Acxiom has led the customer won for IPG, and its data has been integrated into some IPG Agencies.

Krakowsky said In IPG’s first-quarter earnings call last April, Acxiom was linked to strong media performance, and an IPG spokesperson said Acxiom “often plays a fundamental role” in the company’s work. holding company.

However, Acxiom has not been as successful at IPG as Epsilon was at Publicis, sources told ADWEEK.

After the IPG acquisition, some holding agencies were already relying on other data companies, such as Experian, to enrich their clients’ data, and chose to retain existing relationships rather than face the cost of change, two sources said.

“I thought the agencies would welcome us warmly,” said one of those people, a former IPG executive. “But they closed the door and we couldn’t get in.”

“After a few years, they just said enough…”

Acxiom also struggled to establish itself because it did not have all of Epsilon’s abilities. For example, unlike Epsilon, it did not have technology allowing customers to directly activate media from its data, and its LiveRamp identity solution was not part of its sale to IPG.

Two sources told ADWEEK that it was expensive and difficult for IPG to create an activation layer for customers.

The IPG spokesperson said Acxiom has relationships with publishers that allow it to activate data for customers, and that Acxiom also allows customers to activate it through its Interact platform. The platform was announcement October 2024 as an evolution of the year 2019 of the holding company Marketing information enginethe spokesperson said. Although MIE used Acxiom’s data, the spokesperson said, Interact has since centralized it and integrated it with much more of IPG’s data and technology capabilities.

Two different sources with direct knowledge said some IPG agencies rejected Acxiom because their clients were hesitant about pricing and additional fees.

Acxiom has also struggled to explain the value of its solutions, one of these people said. For example, at one point only one customer used its rTAG product, designed to help customers create identity graphics.

“I was trying to understand when they were trying to introduce rTAG to customers, and even I couldn’t get a clear answer as to why it would be useful,” this person said. “No one could tell the story, because there was no story.”

The IPG spokesperson said that now, most large enterprise customers (those who purchase multiple services and products) who ask Acxiom to manage their first-party data use its identification tools, “including Real ID and rTag”.

The leaders would also be sometimes cover Acxiom’s incomplete data sets, two people said.

“I’m not proud of it, but there were many moments in the presentations where the things we presented as Acxiom data were really just other datasets that we licensed and which were the result of Acxiom,” said one of these people. said.

IPG said its InfoBase product is the world’s largest “ethically sourced” database and that it discloses to customers that it works with multiple data partners.

By 2021, IPG has asked its agencies to send more money through Acxiom. And selling Acxiom’s third-party audiences and its other products is now part of those agencies’ quarterly goals, two sources said. An IPG spokesperson declined to comment on quarterly targets.

Many sources noted that efforts to create an integrated data platform appeared to stall in 2023. IPG saw a wave of layoffs and some key accounts losses.

“After a few years, they just said enough, we couldn’t understand,” said another source familiar with the matter.

The holding company combined data and technology agency Kinesso, digital agency Reprise and media buying agency Matterkind in September 2023. In June this year, IPG unified Acxiom under the leadership of Kinesso.

Two sources suggested the attempts may have cost tens of millions of dollars.

The IPG spokesperson highlighted the recently released Interact platform, saying: “We have a roadmap for future modules within Interact and we are investing tens of millions of dollars in it as we are developing new feature sets.

“It’s a complete waste of their time.”

To succeed, Omnicom and IPG need to determine which data asset will be their centerpiece going forward, according to one source.

“They need to make a decision on what will be their official platform,” this person said.

Then Omnicom and IPG have another tough job: extracting and replacing the data, the source added: “And it’s not easy… you have to create entirely new audiences. »

This type of integration work won’t be done in two or three years, this person said: “It’s not going to happen,” adding that they don’t expect Omnicom or IPG have the patience for this.

“It’s a complete waste of their time,” the source said. “They don’t have the time or they won’t do it just because Omnicom wants them to.”

Omnicom’s spokesperson declined to comment on the integration.

Publicis, on the other hand, has already focused on Epsilon. A slide at a recent company-wide presentation looking ahead to 2025 showcased the unit as the data backbone for paid media, owned media, commerce and creative agency Publicis’ newly purchased Influential, according to two sources who saw the presentation.

Publicis has already been able to use Epsilon to quickly develop new products. Three months after buying Influential, Publicis launched a new product called Creator Media Networks, designed to activate media based on who people follow, one of these sources said.

Ultimately, the new Omnicom entity will have its work cut out for it in trying to compete with Publicis’ Epsilon, including getting a strong data platform in place in time before customers flee.