GroupM: the advertising industry will exceed $1,000 billion in revenue for the first time

GroupeM predicts that the global advertising industry will surpass $1 trillion in total revenue for the first time this year.

In his This year Next year Global year-end forecast 2024released today (December 9), media investment firm WPP estimates that global advertising revenue will grow 9.5% this year, up from the 7.8% growth estimate that she had made in her report. mid-year forecast in June.

GroupM predicts that U.S. advertising revenue will grow 9% in 2024, to $379 billion, and 7% in 2025.

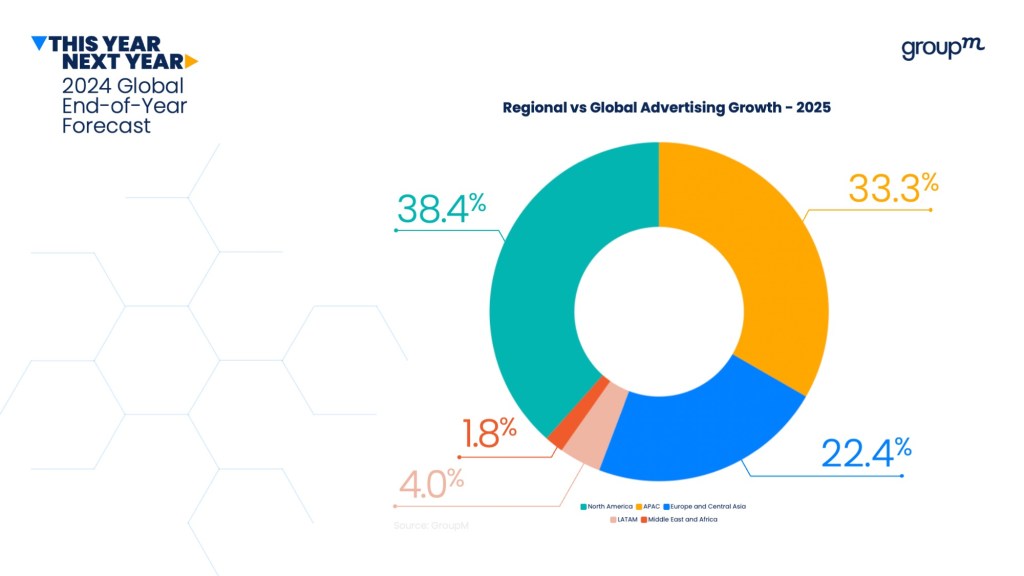

The company predicts that global advertising revenues will reach $1.1 trillion in 2025, with pure digital advertising including extensions such as streaming TV, digital out-of-home (DOOH), and digital newspaper and magazine revenues. , representing 81.7% of the total. .

Television and out-of-home (OOH) will also see growth next year, while audio and print revenues will remain flat and decline respectively.

GroupM excluded the impact of US political advertising in its forecast due to its asymmetric effect on the data. In 2024, political advertising revenue in the United States reached $15.1 billion.

Digital Channels Drive Global Advertising Revenue

Digital channels, excluding traditional media extensions like CTV and DOOH, were the primary drivers of advertising revenue growth in 2024. Pure digital advertising, including search, retail and media social services, is expected to grow 12.4% globally this year and 10% next year, per GroupM.

Kate Scott-Dawkins, global president of business intelligence at GroupM and author of the forecast, said that as digital investments increase, it will be difficult for advertisers to maintain a consistent brand perception across fragmented channels. It is therefore crucial to strengthen recognition so that consumers search for a product by the brand name, rather than generic product names.

As platforms like Google, Meta, ByteDance, and Amazon branch out into channels like search and e-commerce, competition is driving overall market growth. Along with Alibaba, these five companies are expected to generate more than half of all advertising revenue in 2024.

Looking ahead, streaming TV ad revenue is expected to grow 19.3% in 2025, according to forecasts. In the United States, streaming TV ad revenue is expected to grow to account for 35.8% of the total TV ad revenue share.

In the UK, retail media advertising revenue is set to surpass total TV advertising for the first time, reaching £4.7 billion.

In 2024, linear television has benefited from sports marketing, particularly from retailers, thanks to major events such as the Copa América, the UEFA Euros and the Paris Olympics. The latter had a major effect in France, where total advertising revenues increased by 8.5% in 2024.

Top 10 Markets and Global GDP Growth

GroupM predicted the top ten markets for advertising revenue growth in 2025 (in order): US, China, UK, Japan, Germany, France, Canada, Brazil, India and Australia.

GroupeM

GroupeM

Advertising revenue growth is expected to be only slightly higher than nominal GDP growth next year, Scott-Dawkins said, with AI and the recovery of the Chinese market providing recovery potential.

“You’ve had this high point of globalization, alongside self-service and AI-driven platforms, which has led to a massive influx of small and mid-sized advertisers onto digital platforms,” Scott-Dawkins explained.

Negative factors include global trade fragmentation, geopolitical conflicts and potential tariffs.